WMD

Announcements

WMD introduces “Exiting Through M&A,” a course designed for startup and SME founders.

For many startup and SME founders, a question like this often comes to mind:

“Could our company be a candidate for M&A?”

WMD is a leading independent M&A advisory firm in Korea.

We maintain a network of more than 15 global partner firms across 8 countries and have advised on hundreds of M&A transactions.

Based on this advisory experience, we have organized a course to help founders assess whether their company is in a position to consider M&A and to understand what criteria matter when preparing.

In collaboration with Fast Campus, we are pleased to announce the launch of the course:

Exiting Through M&A:

A Practical Guide for Founders Who Are Ready to Take the Next Step

Exit Outcomes Are Shaped by Preparation

M&A can still feel like an option reserved for large corporations.

In practice, however, M&A considerations often involve not only company size, but also business structure and the level of preparation.

Even if an exit is not an immediate plan, founders may eventually face decisions related to ownership transfer, succession, or business closure. Preparing with this possibility in mind can be meaningful.

Among companies with similar profiles, negotiation processes and outcomes may vary depending on how well the company has been prepared.

When preparation is thorough, it becomes easier to articulate a company’s value and strengths, and discussions are more likely to move toward terms closer to the founder’s expectations.

For this reason, while expert advice is essential, it is also important for founders themselves to understand the overall M&A process and prepare in advance.

A Full-Cycle Curriculum Reflecting the Actual M&A Process

The curriculum follows the sequence founders typically encounter when evaluating M&A:

An M&A self-assessment to understand the company’s current position

Exit strategy planning and Information Memorandum (IM) preparation

Due diligence preparation and enterprise valuation

Negotiation strategy and post-transaction considerations

By following the real flow of M&A, the course provides practical criteria and preparation points applicable across the full process.

Practical M&A Guidance, Organized into Approximately 10 Hours

This course is designed as a concise, practical guide for busy founders and is structured as approximately 10 hours of content.

It may be helpful if you:

Want to review your company’s value enhancement opportunities

Wish to design an exit strategy but are unsure where to begin

Are actively considering M&A and want to organize the practical process

Have not decided on an exit yet but are thinking about the company’s next stage

4. Delivered Directly by Active M&A Advisors

The course is delivered directly by WMD’s leadership:

CEO: Greyson (Jemin Lee)

Deputy CEO: John (Sangbin Kwak)

Both instructors are licensed CPAs (KICPA) and Attorneys-at-Law in Korea, and draw on hands-on advisory experience across transactions of various sizes.

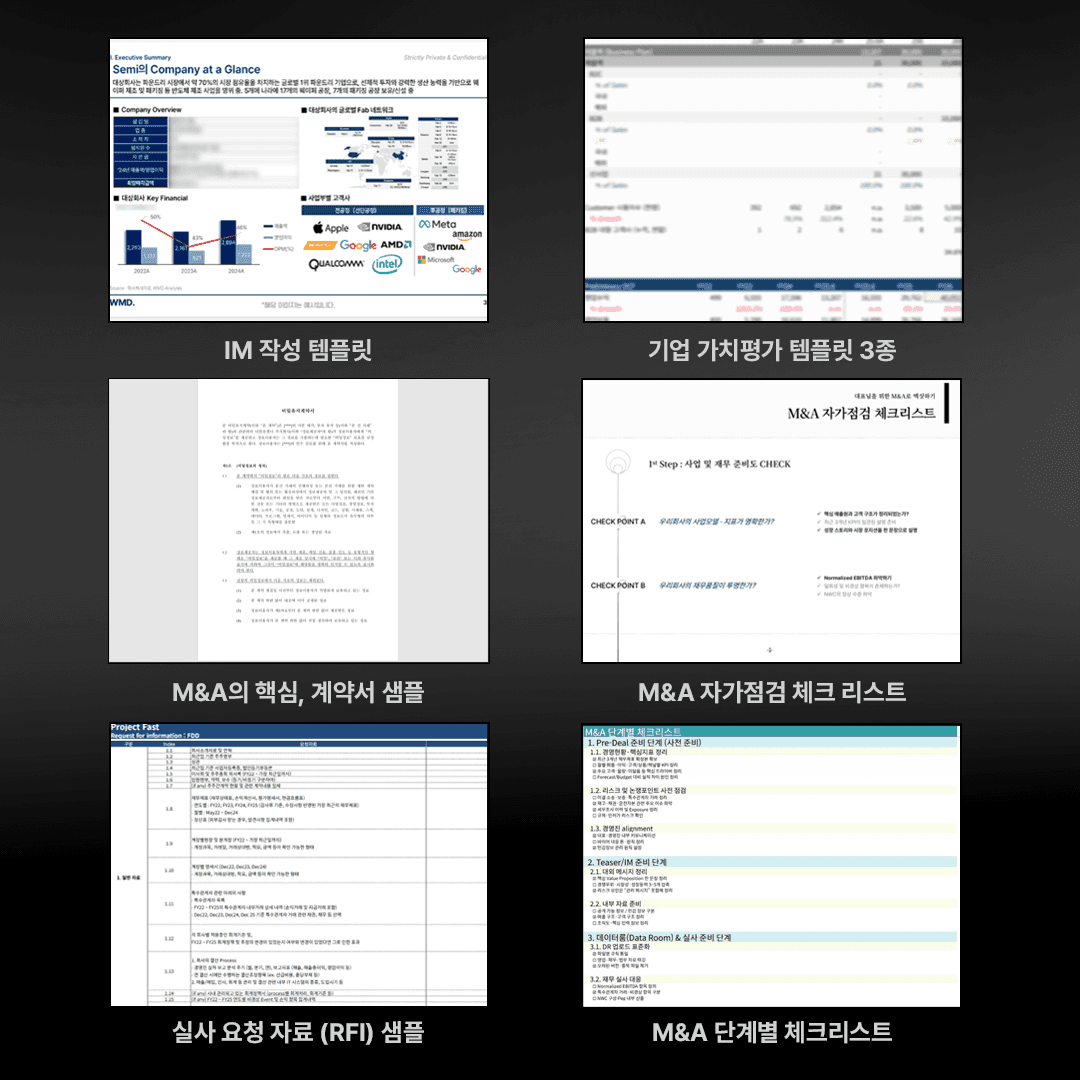

Practical Templates and Reference Materials

Participants receive 10 practical templates and reference materials used in M&A processes, including:

Enterprise valuation templates

Sample M&A-related contracts

Information Memorandum (IM) templates

Due diligence request (RFI) samples

An M&A self-checklist

The aim is to support not only understanding, but actual preparation.

Discount Information

An instructor-issued discount coupon is available for this course.

Discount: KRW 30,000 off

Coupon Code: fc_exit300

How to use: Register for the course → Enter the coupon code at checkout

Validity: The coupon expires automatically 7 days after download

M&A does not have to remain a vague question.

We hope this course helps founders build realistic criteria when considering:

“Could our company be a candidate for M&A?”

(For more details on the course structure and benefits, please click the image below.)